To Buy or Not to Buy…

Posted on Oct 12, 2022

Everyone has been continuously talking about inflation for the last 2 years. Over the past few months, in a panic to control inflation rates, the central bank began raising interest rates. Buyers are finding it hard to get financing, and Sellers are not willing to drop their prices as quickly. Inflation is high and cost of new construction is holdi...

Balanced Market Conditions Have Arrived

Posted on Aug 16, 2022

As for the weather being hot, the real estate market on the other hand is not! We are experiencing interesting times, as some sellers hang on to higher prices and buyer's wait on the sidelines. Homes are definitely sitting on the market for longer and the shift to a Buyer's market has occurred. Mortgage rate hike announcements have been very recent...

A Market of Opportunity

Posted on Aug 10, 2022

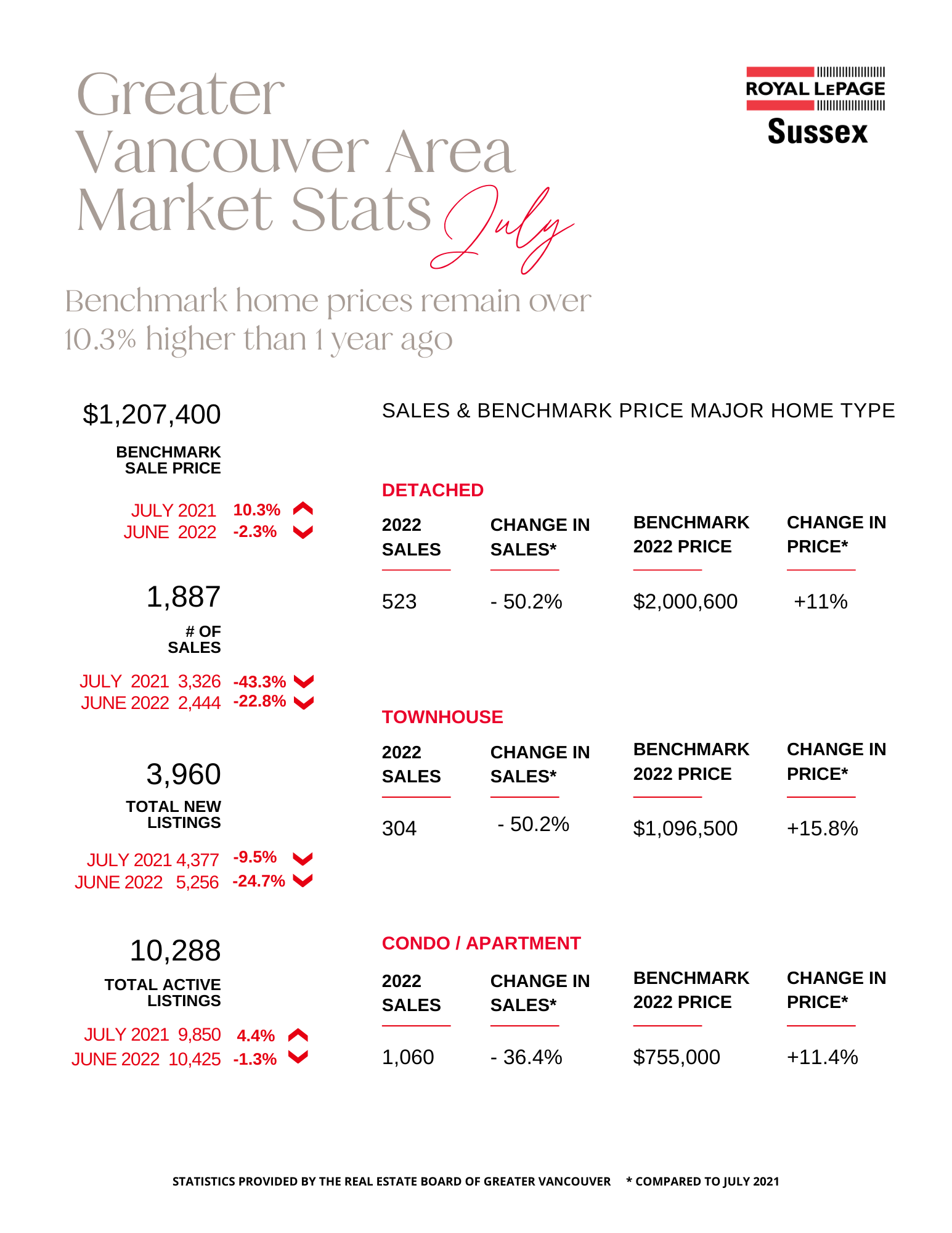

Current market conditions contrast those seen last summer in the throes of the pandemic. With more choice and more value for money, particularly in the detached property segment, buyers looking to enter the market or move up the property ladder are entering a period of strategic opportunity.

“It is important to keep in mind that real estate is and a...

A balanced market returns as market activity decreases, however long term supply issues persist

Posted on Jul 09, 2022

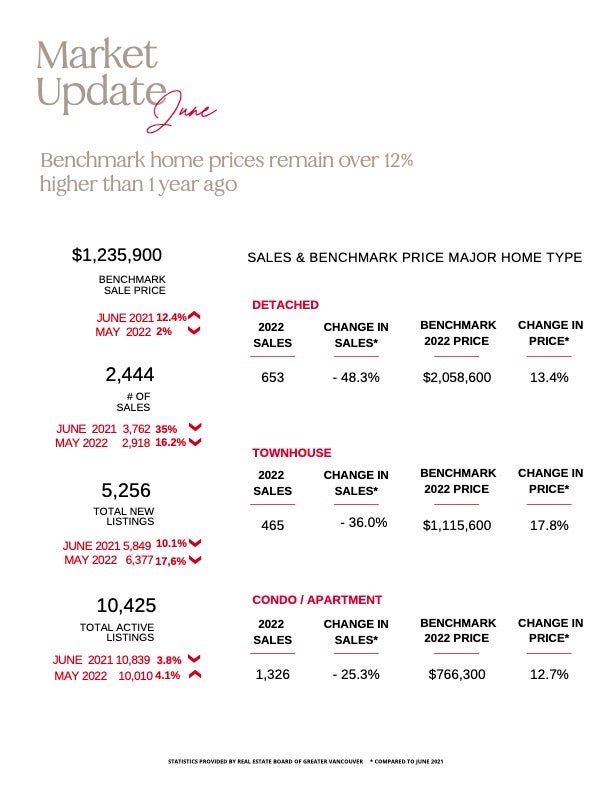

Average home prices are still 5.3% higher than they were in June 2021, and benchmark home prices are a significant 17.9% higher than they were only one year ago.

Consumers saw interest rates and inflation continue to rise, creating more balanced market conditions. However, as purchasers adjust to the increase in borrowing costs later this year, dema...

What Do Rising Interest Rates Mean For You?

Posted on May 06, 2022

The policy interest rate is the fixed interest rate set by a financial institution for a country or group of countries. This determines how much it will cost to borrow money from a central bank.

The Bank of Canada is the one that is regulating our county’s economic activity. Once the Bank of Canada sets the policy interest rate, all other financial...

The Hottest Topic in Real Estate Today is Actually Quite Cold!

Posted on Nov 13, 2021

Photo by Martin Robles on Unsplash

The BC Government announced last week that it intends to introduce a cooling off period and other potential changes for residential real estate transactions next spring.

But what would this look like? Would it put sellers in just as bad of a frenzy that buyers are in today?

The Marketing Act has had a recision perio...